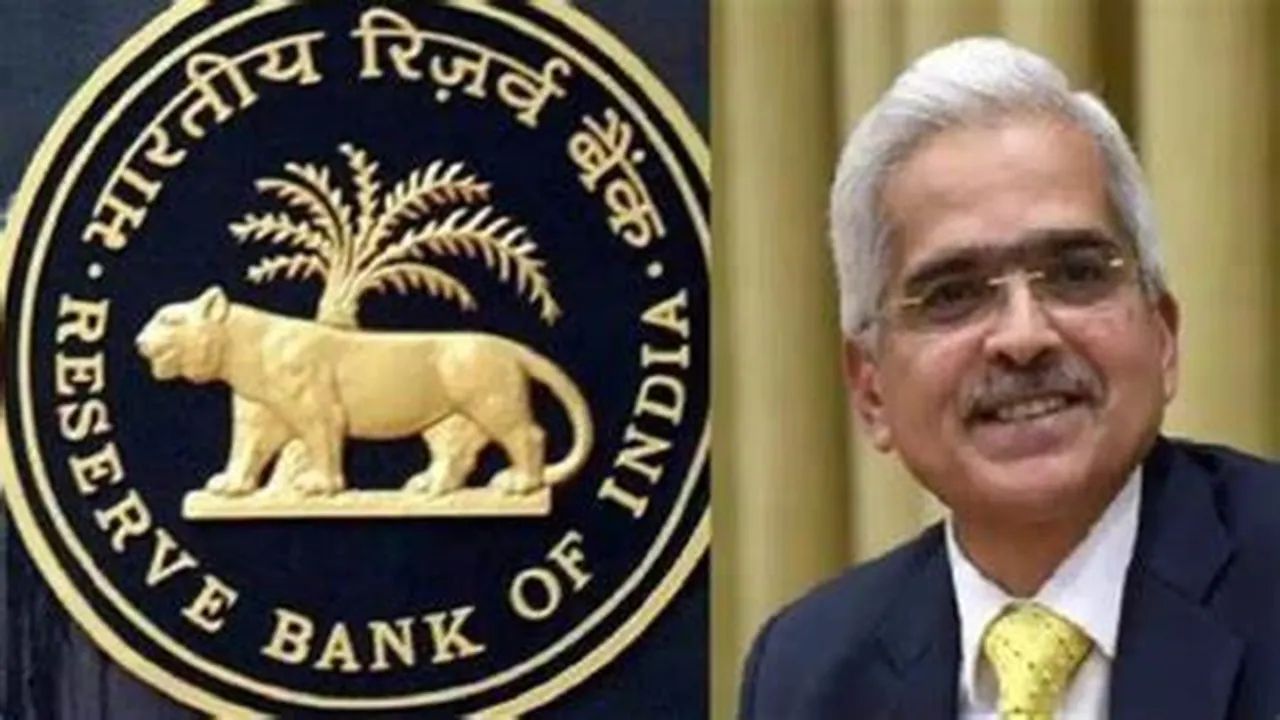

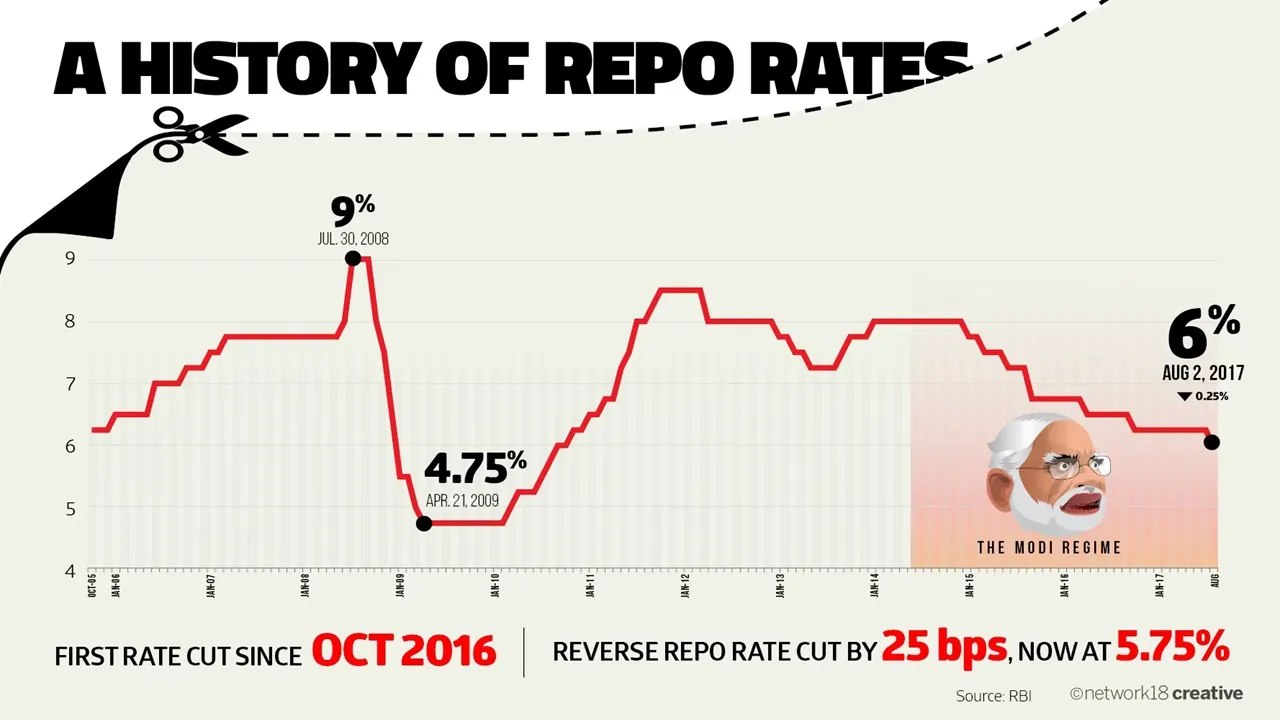

The RBI’s MPC has a consensus on keeping the repo rate unchanged at 6.5 per cent so that the interest rate remains constant. This is so; there was a slight contraction in economic growth in the first quarter of the financial year 2025. The central bank’s manoeuvre can be tasked to address both domestic growth strength and inflation fears at the same time. According to the statement by the Governor of RBI, Shaktikanta Das, the growth rate in India is healthy, but the problem of inflation persists.

RBI Holds Repo Rate, Balances Growth and Inflation

Check Out Hamas Attack: Israel Reflects on One Year Since Devastating Assault

Prices, in general, have been rising with a sensitive eye on food prices; this has kept the central bank vigilant. Since the beginning of the year, especially over the last few months, there has been increased food inflation, and this has brought inconvenience to the cost of living. The economy has gradually remained strong despite a slight slump in the first quarter; hence, the repo rate has been maintained at this level.

The RBI has also changed the monetary policy situation into ‘neutral’, meaning that the policy is more of a growth-oriented one with due account taken on inflation. They would also like to achieve the objective of sustainable growth and development while avoiding soaring prices. Another advantage of the policy stance is that it enables Fundérional en assistance quick responses to new economic conditions, for instance, geopolitical risks that are likely to further escalate inflation.

To get more out of our exclusive news, Join us on our WhatsApp Channel, Facebook, X, and Instagram.