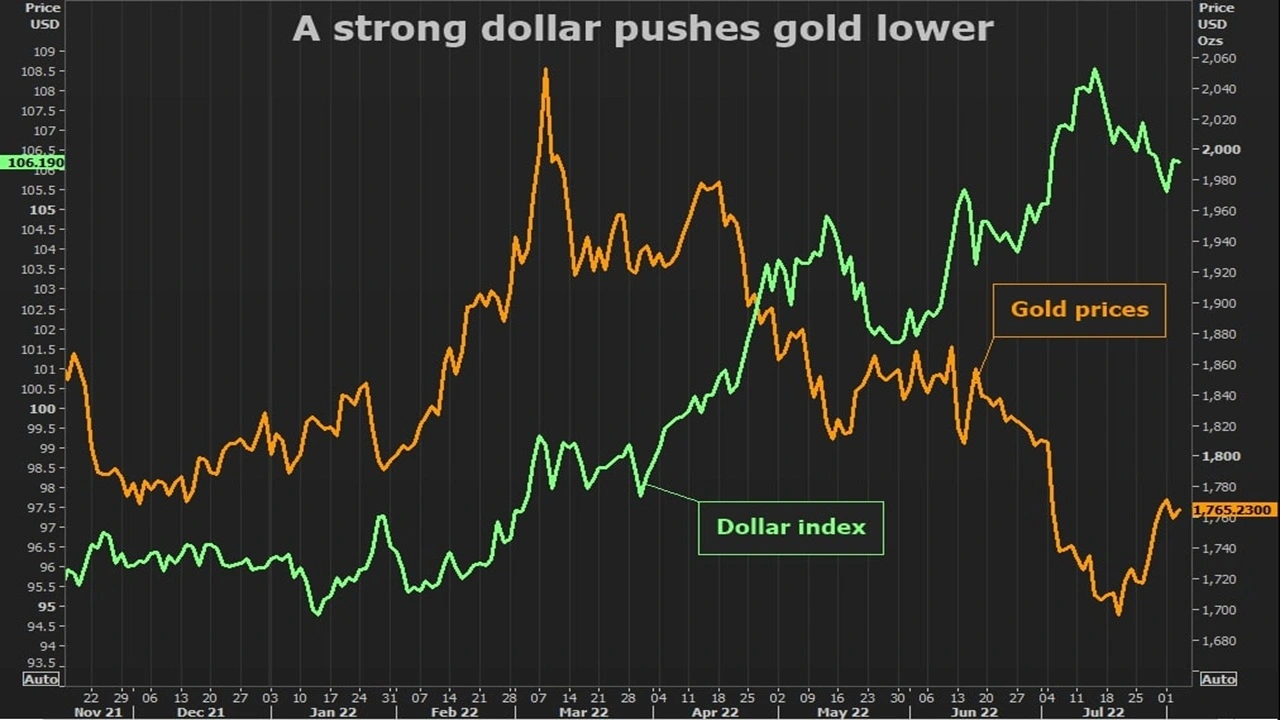

Despite there has been pressure from various other fronts, such as higher US bond yields, a stronger US dollar & rising risk tone in equity, gold prices can face short-term selling pressure, World Gold Council reports. The Council pointed out that these factors increase the opportunity cost of refusing to invest in yielding instruments such as gold, making some people invest in other asset classes, which may even be considered better. November has been rather unkind to the prices because of the US dollar generally strengthens during this period.

Gold Prices Pressured by Strong US Dollar

Check Out Tata Group Completes Merger of Air India and Vistara, Expanding the National Carrier’s Reach

They found out that, due to a stronger US Dollar, it becomes costly for foreign investors to purchase Gold; hence, the low demand is attributed to the strong Dollar. This particular trend, along with the need for higher bond yields, has affected the investment flow to the gold exchange-traded funds. The issue of interest rates has seen many investors move their money from the gold market, seeking yields from interest-bearing instruments. In the WGC report, the reasons for gold prices decline include increased global financial risk-on attitude whereby investors are willing to take more risk by investing in equities.

This spirit undermines the demand for more conventional commodities associated with safety havens, including gold. For that reason, analysts estimate that gold is likely to experience sustained pressure in the near future. However, the constant demand for gold as an inflation and economic risk hedge remains valid if threats of inflation or recession appear again.

To get more out of our exclusive news, Join us on our WhatsApp Channel, Facebook, X, and Instagram.