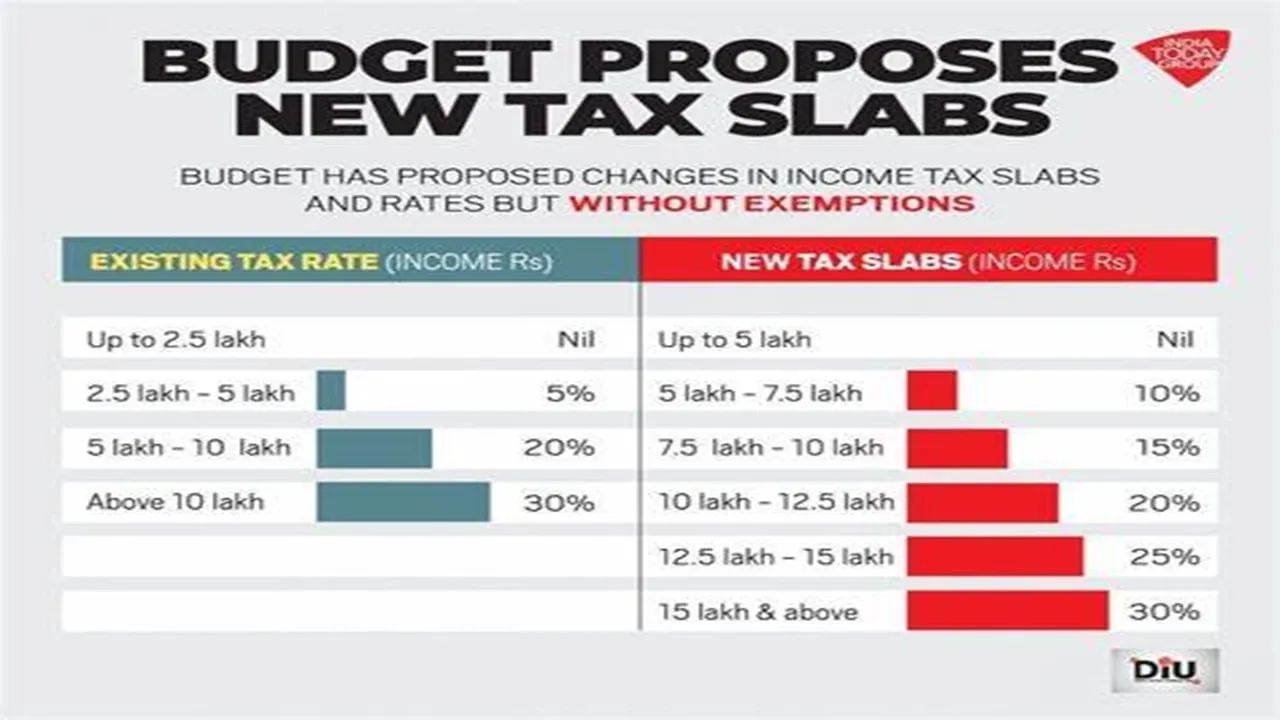

The new financial budget 2024 proposition expects to make the new tax regime more alluring by changing the assessment sections and expanding the standard allowance. In her Budget 2024 speech, Finance Minister Nirmala Sitharaman announced these changes and emphasized the benefits for salaried employees. Under the new tax system, the standard deduction is proposed to go up from Rs 50,000 to Rs 75,000. Salaried employees are expected to benefit significantly from this increase in tax relief.

New Tax Regime Enhanced Deductions and Slabs

Check Out Dalal Street Awaits Budget 2024 Amid Hopes for Capex Boost and Coalition Politics

By allowing taxpayers to save more on their income taxes, the reorganization of the tax brackets will make the new system even more appealing. Due to these changes, salary workers can anticipate saving up to Rs 17,500 on income tax. As a result of the increased standard deduction, taxable income will directly fall, resulting in lower tax bills. This move is part of the government’s effort to make the tax system easier to understand and more advantageous to taxpayers. More taxpayers will likely choose the new tax system due to the proposal to alter the tax brackets and raise the standard deduction.

In contrast to the previous system, the new tax regime provides a straightforward and trouble-free method for calculating taxes and a variety of exemptions and deductions. Salaried workers will appreciate the new tax regime’s proposal to adjust tax brackets and raise the standard deduction. The new tax regime aims to simplify the tax system, provide significant tax relief, and make it more appealing to taxpayers. This move is anticipated to benefit many taxpayers and encourage them to switch to the new tax system due to the potential savings of up to Rs 17,500.

To get more out of our exclusive news, Join us on our WhatsApp Channel, Facebook, X, and Instagram.